18+ 5 percent mortgage

Up from 1 percent in the USDAs 20062008 survey and About 18 percent of those stores classified as convenience stores or small groceries were estimated to have trafficked. 602 Percent Weekly Ending Thursday Updated.

Discover Financial Services 1 In 3 Consumers Plan To Spend Less This Upcoming Holiday Season

But some of 2012 was higher and the entire year averaged out at 365 for a 30-year mortgage.

. The savings and loan crisis of the 1980s and 1990s commonly dubbed the SL crisis was the failure of 1043 out of the 3234 savings and loan associations SLs in the United States from 1986 to 1995. LTV definition and examples March 17 2022 2022 VA Loan Residual Income Guidelines For All 50 States And The District Of Columbia January 2 2020. Freddie Mac said in a press release this week that 30-year fixed-rate mortgages averaged 566 percent with an average 08 point as of September 1 2022 That figure is up from last week when it averaged 555 percent Freddie mac noted while a year ago at this time the 30-year FRM averaged 287 percent.

Occupation code Occupation title click on the occupation title to view its profile Level Employment Employment RSE Employment per 1000 jobs Median hourly wage. Mortgage rates continued to rise alongside hotter-than-expected inflation numbers this week exceeding six percent for the first time since late 2008. As mortgage rates rise fewer.

FHA loans typically require a credit score of 580 or higher and a 35 percent minimum down payment. Persons under 18 years percent. This indicates that while home price declines will likely continue they should not.

While wages grew 52 in July compared to the same time last year they still fell behind the 85 increase in inflation. How do I receive SNAP benefits. Amount of time most experts say the ideal breakeven timeline is 18 to 24 months.

ET by Vivien Lou Chen. Firms falling into the corporate AMT had compliance costs 18 to 26 percent higher than firms not subject to the corporate AMT. Percent of persons age 5 years 2016-2020.

The loan is secured on the borrowers property through a process. In exchange for an initial payment known as the premium the insurer promises to pay for loss caused by perils covered under the policy language. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

For example if your household has less than 100 in liquid resources and 150 in monthly gross income or if your households combined monthly gross income and liquid resources are less than what you pay each month for rent or mortgage and utilities expenses. A mortgage in itself is not a debt it is the lenders security for a debt. Median selected monthly owner costs -with a mortgage 2016-2020.

Closing costs typically range from about 2 to 5 percent of the loan amount. Although the increase in rates will continue to dampen demand and put downward pressure on home prices inventory remains inadequate. Home buyers in.

This is a list of all US-traded ETFs that are currently included in the Real Estate ETF Database Category by the ETF Database staff. During the colonial era the present-day territory of Uruguay was known as Banda Oriental east bank of River Uruguay and was a buffer territory between the competing colonial pretensions of Portuguese Brazil and the Spanish EmpireThe Portuguese first explored the region of present-day Uruguay in 15121513. September 18 2018 Loan-to-value ratio for mortgage.

An SL or thrift is a financial institution that accepts savings deposits and makes mortgage car and other personal loans to individual members a cooperative venture known in. Presently the lowest fixed interest rate on a fixed reverse mortgage is 581 681 APR and variable rates are as low as 5495 with a 1875 marginDisclaimer. Mortgage rates had dropped lower in 2012 when one week in November averaged 331 percent.

The first European explorer to land there was Juan Díaz de Solís in. ET by Joy Wiltermuth First major Wall Street bank to call a US. Households with a computer percent 2016-2020.

About 82 percent of all stores trafficked from 2006 to 2008 compared to the 105 percent of SNAP authorized stores involved in trafficking in 2011. Rates are influenced by the economy your credit score and loan type. The loan origination fee might be 1 percent of your mortgage balance.

The TCJA lowered the METR on equity-financed investment from 355 percent to 223 percent in 2021 see Table 2 while raising the METR on debt-financed investment from -212 percenta tax subsidyto 92 percent. 13 2022 at 509 pm. If the uncertainty attending those projections is similar to that experienced in the past and the risks around the projections are broadly balanced the numbers reported in table 2 would imply a probability of about 70 percent that actual GDP would expand within a range of 15 to 45 percent in the current year 11 to 49 percent in the second.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. Contact your state agency for additional details. 13 2022 at 428 pm.

30-Year Fixed Rate Mortgage Average in the United States MORTGAGE30US 2022-09-15. Computer and Internet Use. Buyers are still facing steep prices and mortgage rates in the high 5.

The average mortgage interest rate is around 55 for a 30-year fixed mortgage. Recession says the pessimists will sadly prevail Sep. Median selected monthly owner costs -without a mortgage 2016-2020.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Interest rates are subject to change without notice. 5-Year Adjustable-Rate Historic Tables HTML Excel Weekly PMMS Survey Opinions estimates forecasts and other views contained in this document are those of Freddie Macs Economic Housing Research group do not necessarily represent the views of Freddie Mac or its management and should not be construed as indicating Freddie Macs business.

Each ETF is placed in a single best fit ETF Database Category. In insurance the insurance policy is a contract generally a standard form contract between the insurer and the policyholder which determines the claims which the insurer is legally required to pay. If you want to browse ETFs with more flexible selection criteria visit our screenerTo see more information of the Real Estate ETFs click on one of the tabs above.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

Survey Here S What Americans Used Personal Loans For During The Pandemic Forbes Advisor

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

How Much Of A House Do You Typically Own After 10 Years Of A Traditional Fixed 30 Year Mortgage Quora

Melissa Monjaraz Loan Officer Guild Mortgage Facebook

Appraisers How To Spend Less Time On Email Appraisal Today

Affordability Page 2 Of 7 Realtor Com Economic Research

Appraisals Check The Water Source Appraisal Today

1

Here Are The Top 4 Barriers To Homeownership Credit Org

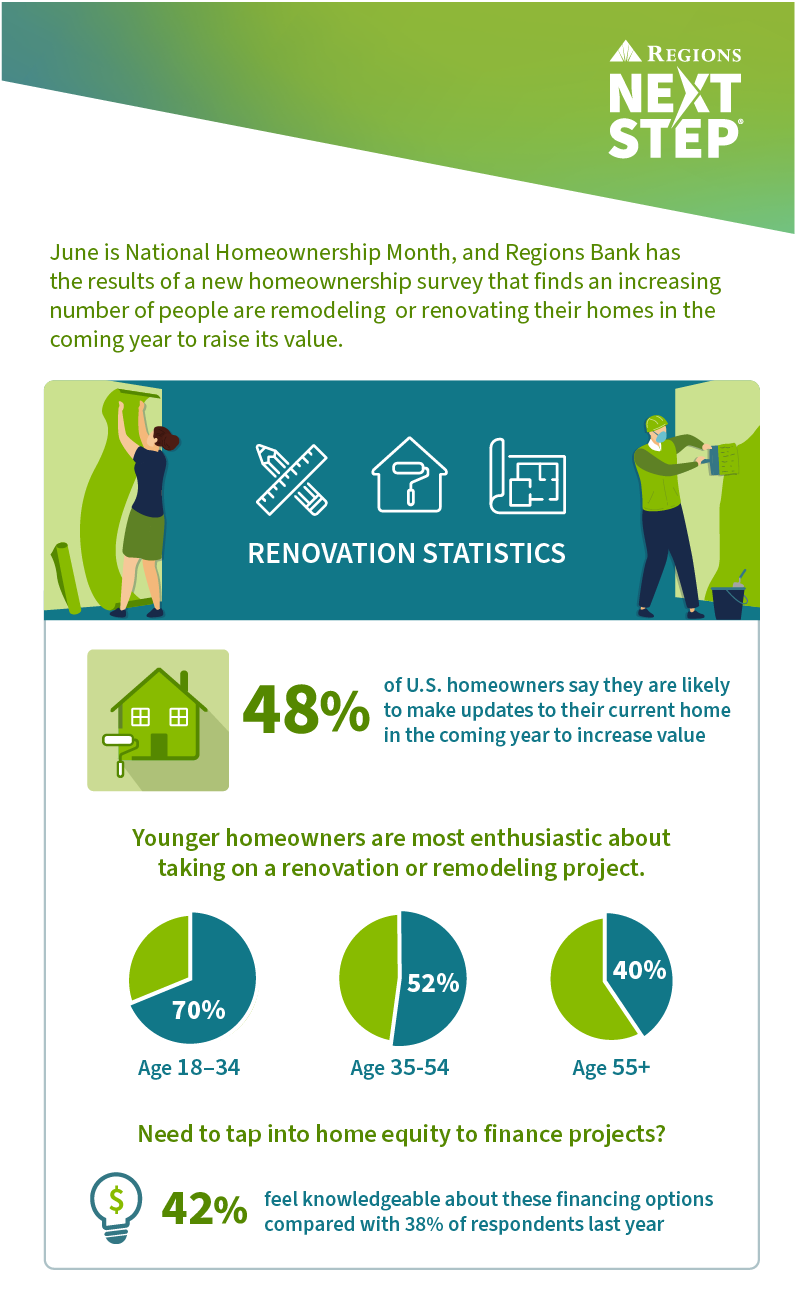

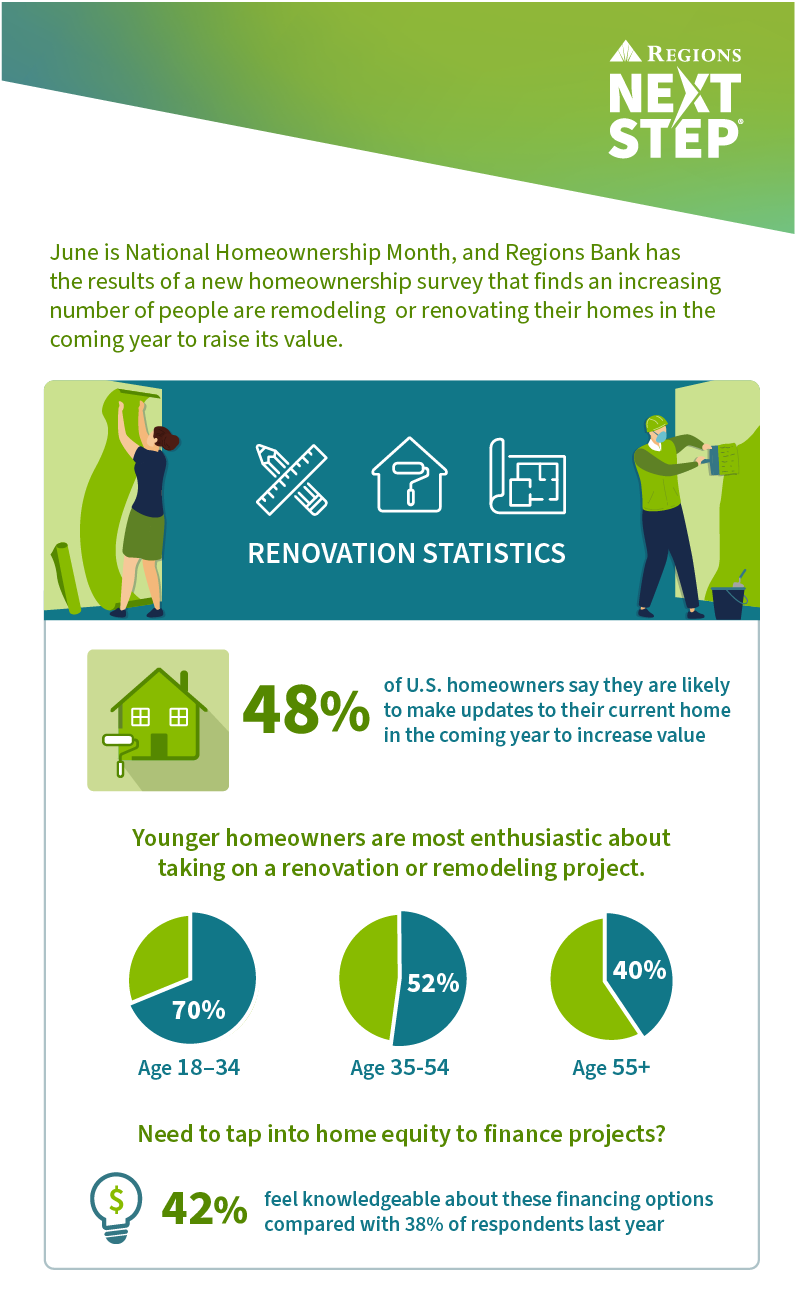

Survey Finds Americans Are Prioritizing Renovations To Boost Home Value

1

1

Price Per Square Foot Not Very Reliable For Appraisals Appraisal Today

1

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

2

Survey Finds Americans Are Prioritizing Renovations To Boost Home Value